The American Rescue Plan (ARP) has increased the Child Tax Credit (CTC) on a temporary basis for 2021. The new expanded CTC will increase to $3,600 per child ages 0-5 and $3,000 per child ages 6-17. Additionally, the ARP...

General Clendenin Bird & Company, PC has always been committed to providing a safe environment for our staff and community of clients and we understand that many of you may have questions when it comes to what we are...

Each spring, Americans remember – at some point – that it’s tax season and that their tax return needs to be filed.

With tax season slowly underway and the average tax refund being around $2,957*, we are often asked “Where’s my refund?”

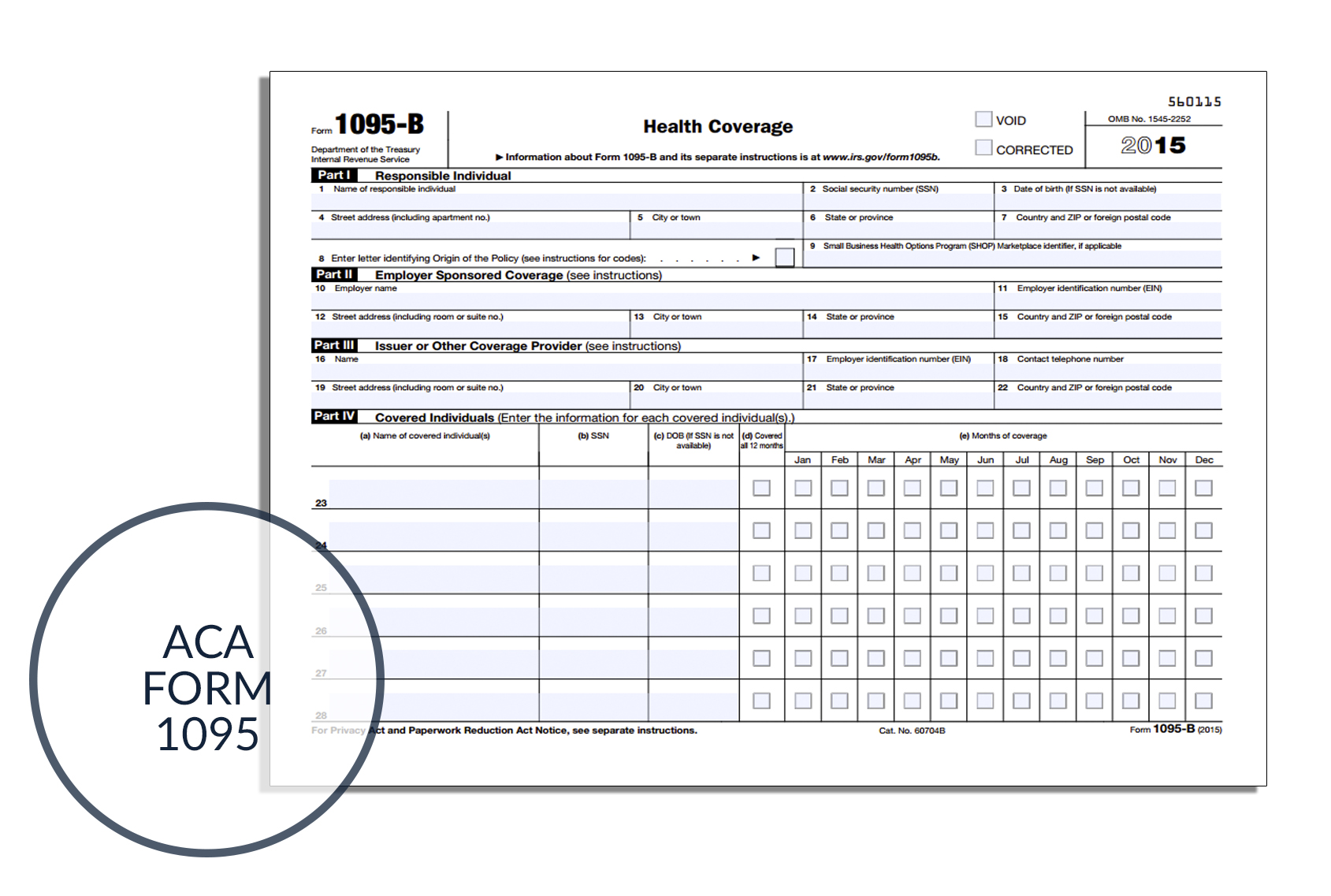

During tax times, we are bombarded with lots of numbers and letters referring to different forms we may need.

Important for any rollover distribution is the 60-day rule.

The Trade Preferences Extension Act of 2015 was signed into law at the end of June 2015. Learn more about what this could mean for your business.

Identity theft is an unfortunate reality.

Each year, about 80% of the almost 150 million total tax filers get a refund.

Need a quick reference guide for 2015 tax deductions and limits? The following guide includes many of the most important federal tax amounts for 2015.