Minimum wage will see another increase on January 1, 2023. Due to the enactment of Senate Bill (SB) 3, the California minimum wage will increase to $15.50 per hour, effective January 1, 2023, for all employers. Image by...

The American Rescue Plan (ARP) has increased the Child Tax Credit (CTC) on a temporary basis for 2021. The new expanded CTC will increase to $3,600 per child ages 0-5 and $3,000 per child ages 6-17. Additionally, the ARP...

Same team. Different name. Clendenin Bird & Company, PC is now Gallagher Gatewood, a Professional Accountancy Corporation

General Clendenin Bird & Company, PC has always been committed to providing a safe environment for our staff and community of clients and we understand that many of you may have questions when it comes to what we are...

Knowing when and what you have to file can save you a lot of headaches at tax time. To avoid paying penalties, mark your calendar with the following important tax deadlines between July 1 and September 30, 2018.

Each spring, Americans remember – at some point – that it’s tax season and that their tax return needs to be filed.

Back in 2014, President Obama directed the Secretary of Labor to update the overtime regulations to better reflect the Fair Labor Standards Act.

With tax season slowly underway and the average tax refund being around $2,957*, we are often asked “Where’s my refund?”

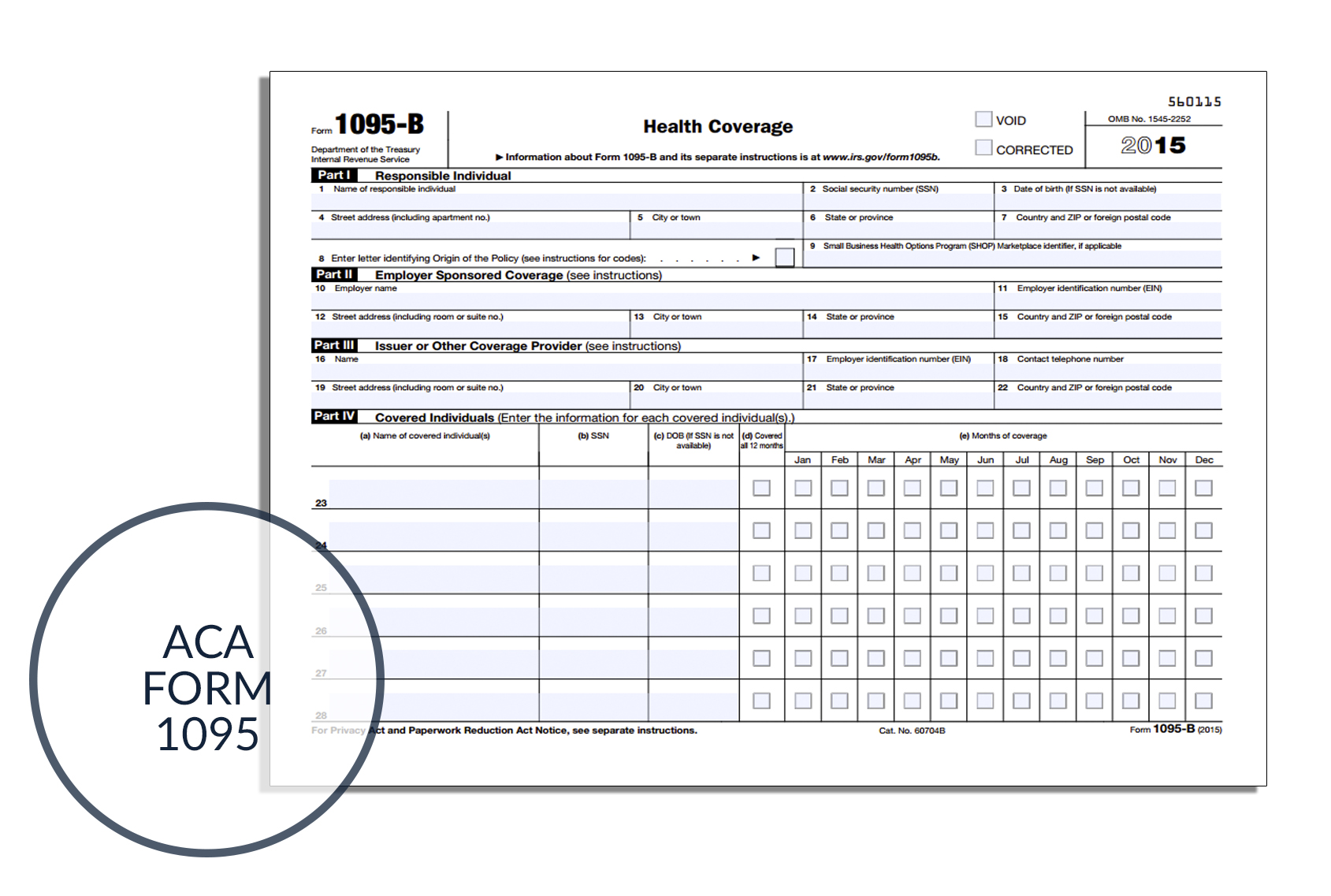

During tax times, we are bombarded with lots of numbers and letters referring to different forms we may need.

Important for any rollover distribution is the 60-day rule.