During tax times, we are bombarded with lots of numbers and letters referring to different forms we may need.

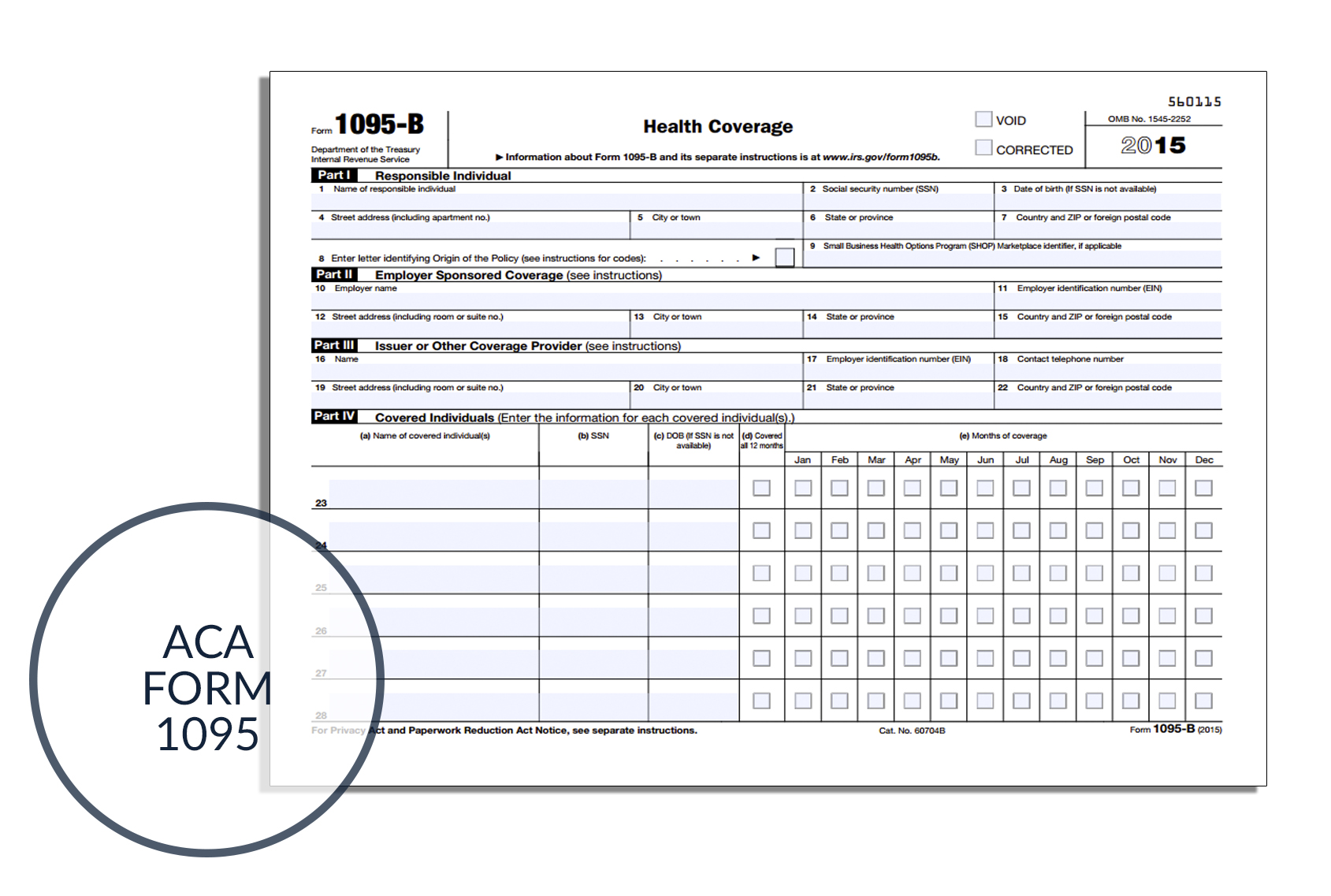

The most common, or well known, are most likely the Form 1040 and W-2. The one form that a large portion of taxpayers will be getting to know is Form 1095 and its various versions. The IRS recently released final regulations concerning these information returns.

WHAT IS FORM 1095 AND HOW MANY ARE THERE?

The form comes in three versions: 1095-A, 1095-B and 1095-C. A 1095 will explain where you received health insurance coverage from, who was covered on the plan and how long that plan provided benefits to you.

WHICH ONE WILL I RECEIVE?

If at any point during the year you had health insurance provided from:

- A marketplace plan (except catastrophic plans), you will receive Form 1095-A

- An applicable large employer (50+ employees), you will receive Form 1095-C

- Any other insurance providers*, you will receive Form 1095-B

* Under federal regulations, it is the responsibility of insurance providers to send out Form 1095-B. A sponsor is whoever arranges the health coverage; while a provider is a company or organization that actually pays the bills. When people enroll through health coverage offered by an employer, the employer is the sponsor and the insurance company is the provider. A self-insured employer is both sponsor and provider.

EXAMPLE

John was a self-employed contractor at the beginning of 2015. He enrolled through Covered California for coverage from January through May. He was hired full-time and received health coverage through his large employer for the rest of the year. John will receive one 1095-A and one 1095-C.

WHEN AND WHY WILL I RECEIVE THIS?

Beginning in 2014, individuals are required to be covered by health coverage that provides at least “minimum essential benefits” or else be subject to penalties (Individual Shared Responsibility Payment).

Form 1095 provides information that is used on your Form 1040 to verify you had coverage or to calculate any penalty owed and, in some cases, to reconcile any Premium Tax Credit received. Form 1095 should be mailed to you by February 1, 2016.

Please contact us if you have any questions about the Affordable Care Act and Form 1095.